How to calculate alpha in Excel

You can watch a video tutorial here.

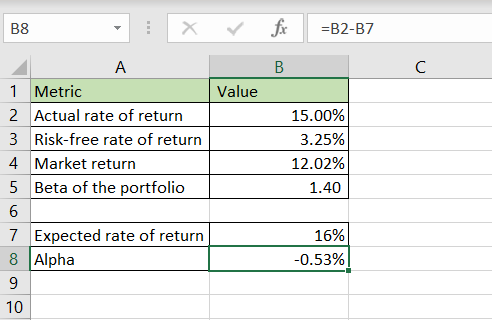

To calculate the Alpha in Excel, you need to have the following information in place:

- Actual rate of return of the portfolio

- The Risk-free rate of return

- The Market return

- Beta of the portfolio

Alpha is an important metric used by portfolio managers to measure whether a portfolio has performed better or worse than the market. The formula for calculating the Alpha of a portfolio is:

Alpha = Actual Rate of Return – Expected Rate of Return

> The Actual Rate of Return can be computed based on the actual performance of the portfolio

> Expected Rate of Return = Risk-free rate of return + Beta * (Market return – Risk-free rate of return)

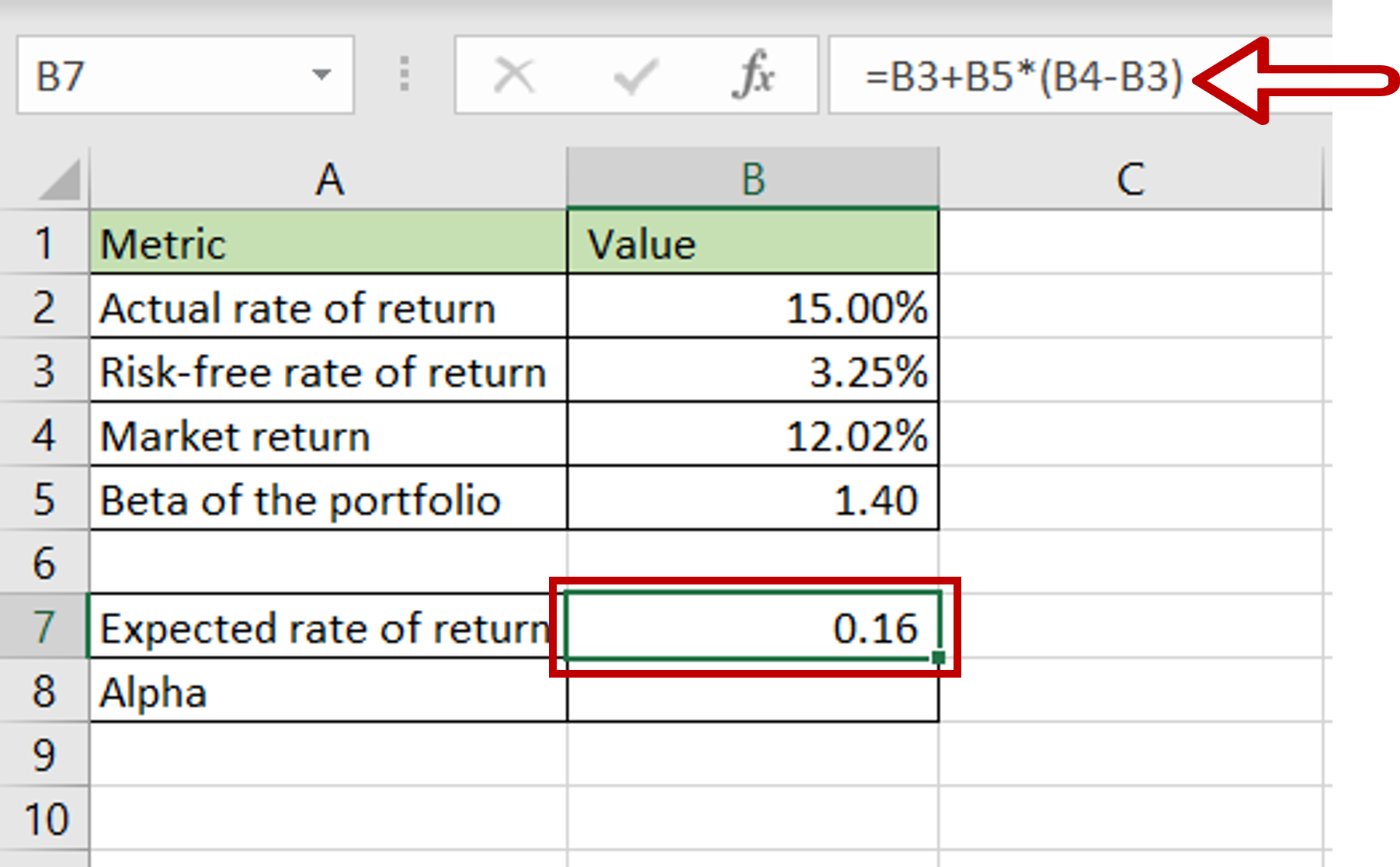

Step 1 – Compute the Expected Rate of Return

– Select the cell where the result is to appear

– Type the formula using cell references:

= Risk-free rate of return + Beta * (Market return – Risk-free rate of return)

– Press Enter

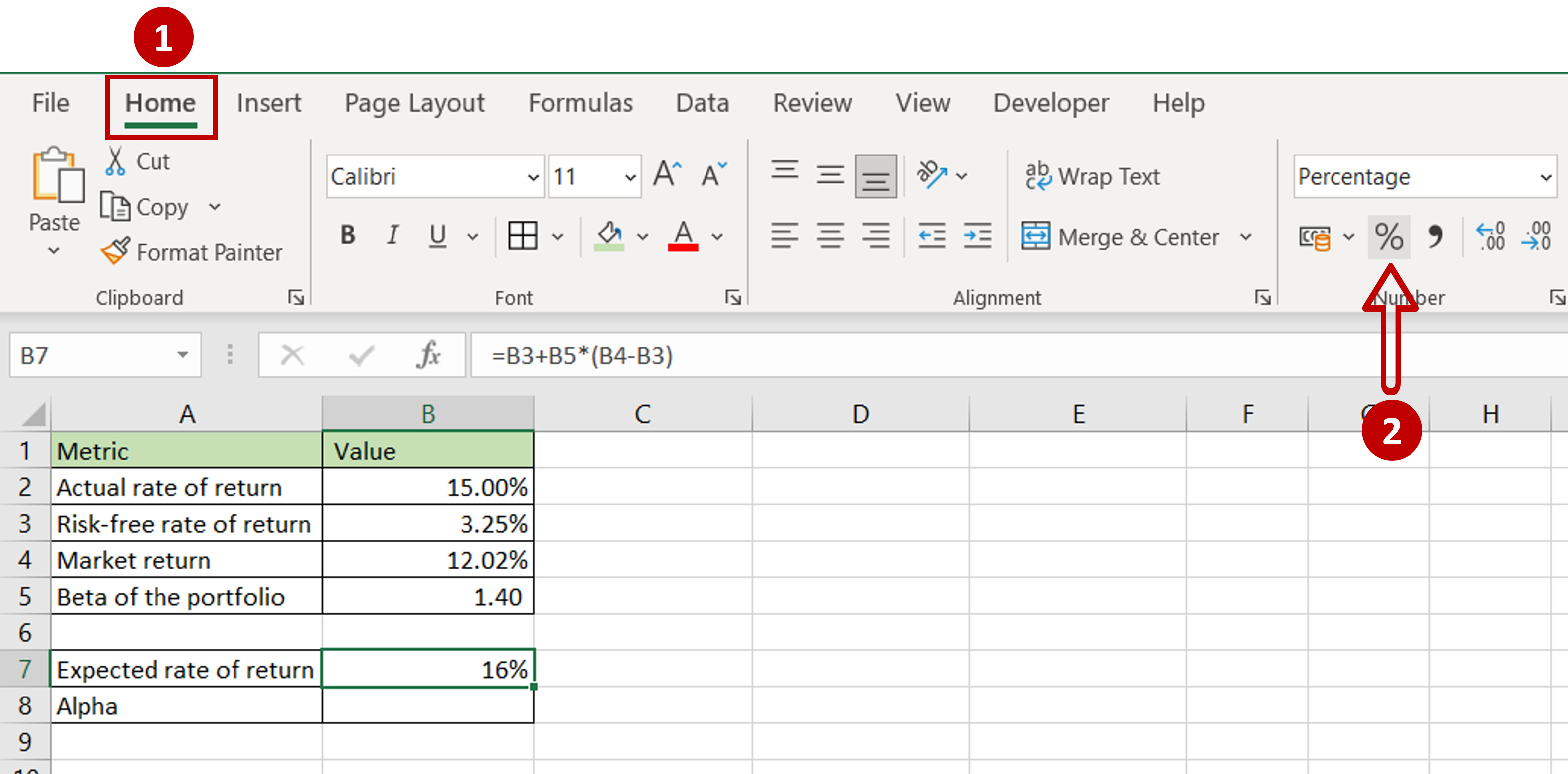

Step 2 – Convert to percentage

– Go to Home > Number

– Click on the percentage (%) button

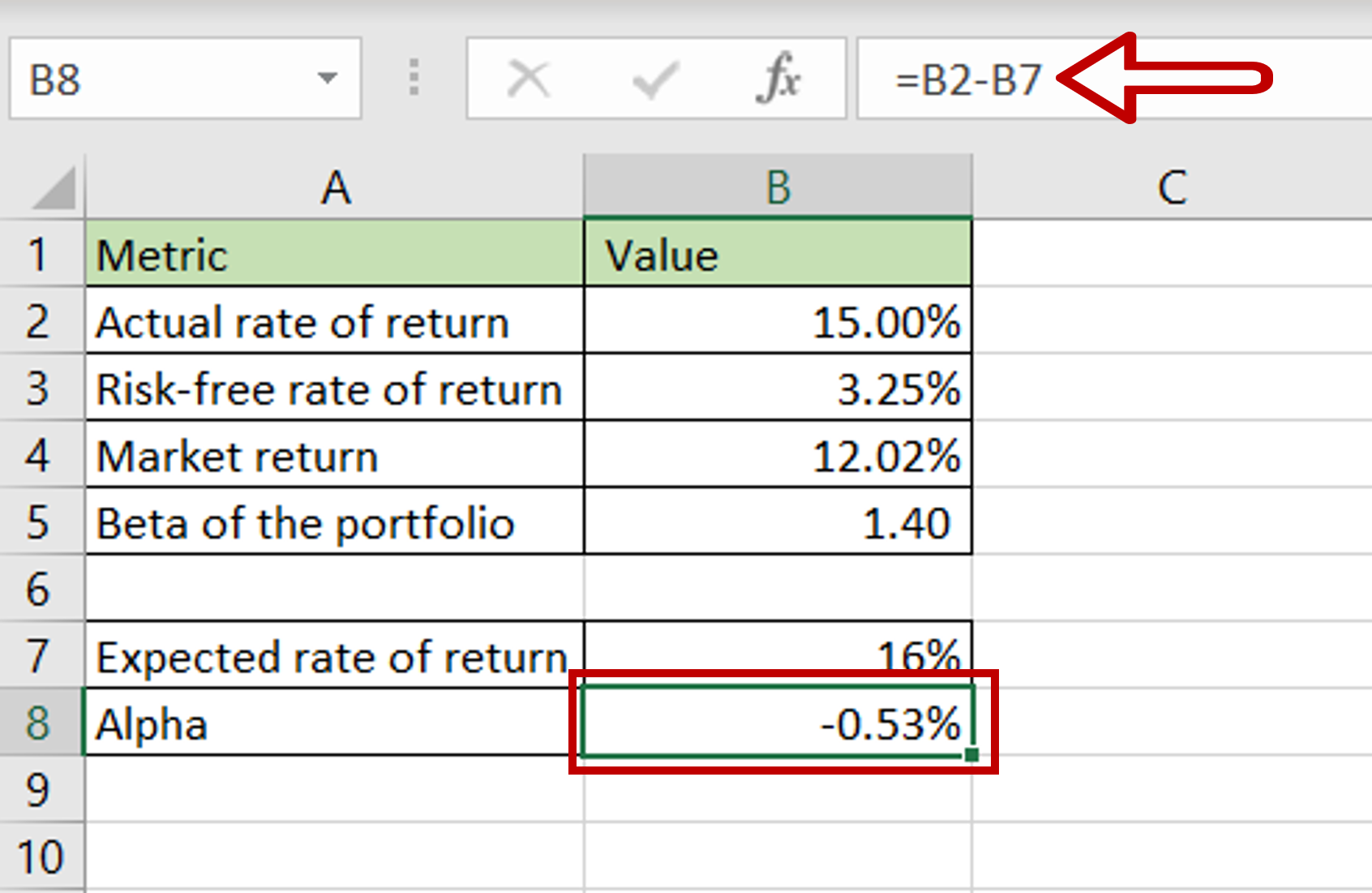

Step 3 – Enter the formula for Alpha

– Select the cell where the result is to appear

– Type the formula using cell references:

= Actual rate of return – Expected rate of return

– Press Enter

– The Alpha is displayed